Good financial planning software is an essential tool for today's financial advisor. Yet the reality is that it's incredibly difficult to determine what is the best financial planning software. in part because advisors vary in how they use financial planning software in the first place, which means what is the "best" software for one advisor may be a terrible match for another.

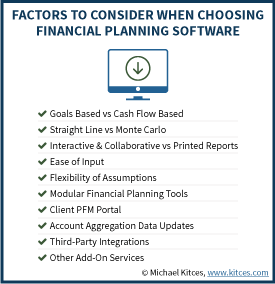

In this financial advisor's guide to the best financial planning software, we attempt to clarify what the important criteria are in choosing financial planning software in the first place, in recognition that what might be a crucial "deal-killer" required feature for one advisor may not even matter to another. Whether it's the distinction between goals-based and cash-flow-based retirement projections, to the ease of input, the depth of the output (especially in technical areas like detailed income and estate tax projections), available integrations to other components of the financial advisor technology stack, or the availability of account aggregation and "PFM" tools. the reality is that no financial planning software is the "best" at everything, so trade-offs must be considered.

In addition, as someone who's seen virtually every financial planning software company in the landscape - including some that aren't even around anymore - the end of this guide includes my own brief high-level review of each of the leading financial planning software packages (including some of the newest players, too), to give further context to each software package's strengths and potential weaknesses. Also included are the pricing details of the various financial planning software packages, which still have a remarkably amount of variance for what are nominally "similar" financial planning software tools!

I hope this guide is helpful to you in considering whether you're got the "right" financial planning software, or whether there may be an alternative solution out there that's a better fit for your business and client needs!

Michael Kitces is Head of Planning Strategy at Buckingham Strategic Wealth, which provides an evidence-based approach to private wealth management for near- and current retirees, and Buckingham Strategic Partners, a turnkey wealth management services provider supporting thousands of independent financial advisors through the scaling phase of growth.

In addition, he is a co-founder of the XY Planning Network, AdvicePay, fpPathfinder, and New Planner Recruiting, the former Practitioner Editor of the Journal of Financial Planning, the host of the Financial Advisor Success podcast, and the publisher of the popular financial planning industry blog Nerd’s Eye View through his website Kitces.com, dedicated to advancing knowledge in financial planning. In 2010, Michael was recognized with one of the FPA’s “Heart of Financial Planning” awards for his dedication and work in advancing the profession.

Read all of Michael’s articles here.

Financial planning software is an essential tool for any bona fide financial advisor, in a world where projecting the long-term impact of financial trade-offs – necessary for any consumer/client to make a good financial decision – is far too complex to be done without technology to assist. Good planning software fills the void by doing the requisite ‘number-crunching’ necessary to calculate projected outcomes, so that a client can evaluate the consequences of any particular financial trade-off or decision.

Yet the reality is that while the origin of financial planning software was simply a complex “financial planning calculator” tool, in today’s environment being able to effectively calculate projected outcomes is merely the “table stakes” that any financial planning software must be able to achieve to have a seat at the table. The real differentiators for financial planning software in today’s marketplace are about what can be accomplished when using the tool live, collaboratively, in real time with a client. And financial planning software companies are always trying to come up with the next new differentiating feature and approach.

However, because not every advisor serves the same types of clients, focuses on the same types of problems, or has the same approach to analyzing financial planning situations and presenting them to clients, it’s actually remarkably difficult to simply identify one clear “best” financial planning software. Instead, choosing the best financial planning software is really about finding the best for you, the types of clients you work with, and how you will choose to integrate the software into the process (and possibly integrate it to the rest of your technology as well).

For nearly 20 years, “goals-based” vs “cash-flow-based” has been one of the key differentiators amongst the types of financial planning software. The distinction refers to detailed assumptions regarding how a household’s total cash flows are handled in the software.

Goals-based financial planning software captures dollars that are allocated towards a specific goal (or multiple goals), and projects whether the goal(s) will be achieved. Thus, for instance, if a household had committed $20,000/year towards saving for retirement, and $5,000/year in college savings, goals-based software would evaluate whether those savings, plus assumed growth rates, are likely to achieve the goal. This might be projected on a straight-line (“linear”) basis, or modeled to account for uncertainty with a Monte Carlo analysis (see further discussion below on “modeling”). Notably, though, with goals-based planning, there isn’t necessarily any tracking of what the household earns in total, and where all the dollars are going; instead, the approach simply assumes that dollars to be allocated towards specific goals that have been determined already, and then projects those outcomes. Whether the household can even afford to achieve that targeted savings goal is up to the advisor to figure out with the client in the first place.

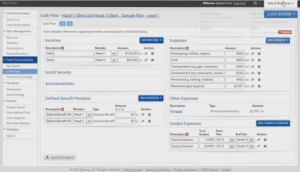

By contrast, cash-flow-based financial planning software typically aims to account for every dollar in the household – combining all the total inflows from various sources (income from wages and self-employment, portfolio income, etc.), and ensuring that they fully match the total outflows (whether to some form of spending or allocated to saving). Thus, for instance, a household that has $100,000 of income might allocate $20,000/year towards saving for retirement and $5,000/year in college savings, but the software would also make allocations for the household’s spending in various categories, its tax obligations, etc. In other words, the analysis doesn’t just include the cash flows towards particular goals, it tracks all the cash flows. Notably, this means if the client's spending and saving goals add up to more money than the household has in cash flow, the software will reflect a deficit in recognition of the shortfall (which wouldn't typically be included in a goals-based analysis).

Historically, the challenge with cash-flow-based planning software – for which NaviPlan was long the leading platform – is that accounting for and projecting out “every” cash flow allows for the most thorough analysis, but can be a very tedious process (especially for software in the past that wasn’t very user-friendly). On the other hand, MoneyGuidePro has been the leading proponent and champion of the goals-based planning approach, recognizing that often tracking "every" cash flow for the "most thorough" analysis isn't really necessary, and that the planning process can be greatly expedited by reducing the focus from tracking every cash flow in the household to just capturing “the ones that matter” towards specific goals instead.

Notably in today’s environment, the dividing lines between “cash flow based” and “goals based” financial planning software have blurred, as goals-based users of platforms like MoneyGuidePro often include many goals (so many, that virtually all cash flows are accounted for anyway), while cash-flow-based platforms like NaviPlan increasingly focus not just on the cash flows themselves but the goals towards which they’re being allocated.

Nonetheless, from a perspective of software design and focus, goals-based vs cash-flow-based financial planning software is still a very meaningful distinction. Those who prefer to delve into the details of long-term cash flow projections, particularly in situations with significant wealth and complexity, or simply where those details are important, will likely be unsatisfied by goals-based software. On the other hand, those who want to focus on how planned savings/allocations towards particular goals project in the long run – but don’t necessarily want to account for the minutia of every household cash flow (over a multi-decade time period!) – may strongly prefer goals-based planning software.

Another important distinction in financial planning software is how it models the projections themselves. Does the software simply project on a “linear” straight-line basis – e.g., projecting a flat annual return of 6%, 8%, or whatever assumptions are entered? Or does the software project a wider range of returns using Monte Carlo analysis?

Similarly, what is the capacity of the software to project and analyze various alternative or “What-If” scenarios? Can the financial planning software easily provide side-by-side comparisons of potential trade-offs that a client might be considering? Is the software able to project a “bad returns” scenario and show the client how spending must be adapted to stay on track? Does the software make it easy to vary the inputs to the plan, to show how the plan outcome(s) may be more sensitive to some planning assumptions or inputs versus others (so the client understands what is truly driving the outcome)?

A related issue also of concern to at least some advisors (and some clients) is whether the software is a “black box” or whether the calculation engine can validate the numbers that the software produces as output. Some financial planning software, like MoneyTree, provides a detailed “audit trail” that can be used to verify the source and calculation of every number produced in the output reports, while other software is notorious for being difficult to reproduce the calculated results (e.g., MoneyGuidePro).

How financial planning software models taxes in particular also varies greatly from one software package to the next. Some tools will only allow for a basic assumption regarding effective tax rates (perhaps split into an effective tax rate during working years and a different one in retirement), while others will actually do detailed year-by-year tax projections based on the actual tax brackets and projected income, along with the actual rules and limitations for various deductions. Financial planning software tools also vary greatly in their ability to capture state-specific income tax rules (or not).

In the past, the primary output of financial planning software was “the” financial plan – an extended series of report printouts, potentially numbering dozens of pages, detailing the projections of the software and their results. Some financial advisors would add to these printouts several additional pages of the plan deliverable for clients, with their own analysis and commentary, along with action items and perhaps an executive summary. But the whole thrust of the “financial planning process” was about gathering data, inputting it into the software, and producing a report – “the plan” – from the output.

In today’s environment, most financial planning software is still capable of providing printed report outputs, but as financial planning software increasingly shifts from just being a “calculator” tool for the advisor to a collaborative tool to be used with the client, there is an increasing focus on whether and how the software can be used “interactively” with clients as well. In other words, rather than simply gathering client data, inputting it into the software, and printing the reports for clients, the data is added to the software and the advisor-and-client together take the plan for a “test drive” and see how it will handle under various conditions.

Why this matters from the perspective of selecting planning software is that, simply put, some software looks a lot better in front of clients than other tools. And not all financial planning software is built to accommodate such a process of changing the inputs on the fly to see the impact on the outcomes. For instance, to test an alternative scenario with a client like “what if I tried to save another $10,000/year to retire 2 years earlier”, software built for an interactive collaborative financial planning experience with clients might have some handy sliders to “drag” the retirement age and savings levels up and down to see the outcome, while other tools might require the planner to delve back into the guts of the software’s input screens to adjust these underlying assumptions (a far less appealing experience for the client sitting there watching the advisor dig around for where to change the software inputs!).

In addition to the focus on the output of financial planning software, as the financial advisor who will use the software, the ease and flexibility of the financial planning software input process matters, too. Ease of input can impact everything from the raw time it takes to put client data into the plan, to the steepness of the learning curve to get up to speed on how to use the software in the first place (as the harder and more complex the input process, the more training it takes on how to do it properly!).

To some extent, the “ease of input” for financial planning software is simply driven by the quality of its design process in the first place. Some tools have a more natural layout and flow to inputting the data, while others require more digging. Beyond that, the reality is that the more “detailed” the software is – e.g., if it’s intensively cash-flow based – the more input work there tends to be up front (and the reduced data input burden has been one major reason for the popularity of “goals-based” financial planning software).

Also relevant for many planners is the flexibility of the software’s assumptions, with constraints that will vary greatly from one financial planning software platform to the next. In some cases, the software will “force” you to use pre-set inputs determined by the software makers – which may be a welcome expediency for those who are happy with the default assumptions, but a deal-killer for those who prefer to use their own inputs. In the context of investment/portfolio assumptions in particular, some tools will allow a broad-based average return (and standard deviation), while others will allow inputs at the asset-class or individual investment level. Some only allow for return (and/or standard deviation) assumptions to be changed, while others allow the advisors to set an entire cross-correlation matrix to run a robust Monte Carlo projection.

For most financial planning software, the central focus is on projecting the accumulation of wealth, and its subsequent decumulation in retirement (due no doubt to the focus of so many financial planners on managing retirement assets or implementing those assets into retirement products!).

Nonetheless, many clients do have needs in other modular areas of financial planning, from evaluating insurance coverage to making a decision about the timing of when to start Social Security. Different financial planning software programs vary greatly in the financial planning modules they include beyond just the core accumulation/distribution projections, but may include:

- Life Insurance. Performs a capital needs analysis to determine whether the current amount of life insurance coverage is sufficient, based on projected other income, spending goals, and available assets.

- Disability Insurance. Evaluate whether there is sufficient disability income insurance to cover spending needs in the event an earner becomes disabled.

- Long-Term Care Insurance. Illustrate the consequences of a long-term care event on the retirement plan, and then show how long-term care insurance may help to fill the gap (along with the impact of paying the premiums).

- College Savings. This module may include both projecting the accumulation of college funds based on current savings, and whether there will be “enough” to cover future college costs. More robust versions of college planning tools may include a database of most/all US colleges, and their costs (both tuition, and also room and board) to more easily determine required college saving based on particular target schools.

- Social Security Timing. How is the plan impacted depending on whether the retiree starts Social Security early or late, and what are the opportunities to coordinate the timing of Social Security claiming with a couple (which still matters, even with the elimination of File-and-Suspend and the wind-down of Restricted Application)? Some Social Security calculator tools will also help determine projected Social Security benefits based on continued work in the years leading up to (or even in) retirement. (Other popular stand-alone tools for advisors analyzing Social Security claiming strategies include Social Security Timing, Social Security Solutions, and SSPro.)

- Retirement Drawdowns. While virtually all financial planning software at least illustrates the basic impact of taking net withdrawals from the portfolio, not all tools can do sophisticated modeling of tax-sensitive drawdowns from various types of retirement accounts, or incorporate the impact of annuitization or taking life insurance policy loans. (This is another area where several stand-alone tools for illustrating strategies have become popular, including Income Discovery, RetireUp, and Wealth2k.)

- Stock Options and Executive Compensation. Illustrate both the tax and investment consequences of various liquidation strategies of qualified and nonqualified stock options (and restricted stock). (Notably, there is arguably still no financial planning software capable of doing this kind of analysis in the depth of standalone specialized tools like StockOpter.)

- Tax Planning. Analysis of specific tax planning opportunities, such as the impact of tax-sensitive retirement spenddown strategies, systematic partial Roth conversions, etc. Historically, most planning software has been very limited in its ability to illustrate tax planning strategies, leading advisors to adopt standalone tools like BNA Income Tax Planner, although a new breed of financial planning software solutions like RightCapital are delving into illustrating tax strategies as financial advisors become less product-centric and more focused on delivering value-added advice.

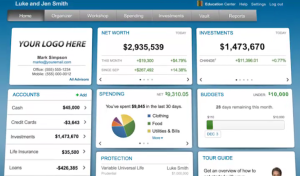

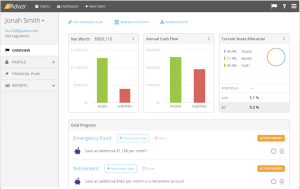

As financial planning software continues its transition from being an “advisor calculator” into a holistic “financial planning experience” for clients, an increasingly important aspect of financial planning software is the “portal” or personal financial management (PFM) dashboard provided to clients. And although historically financial planning software has been very light on PFM tools for clients, an increasing number are either building their own solutions (pioneered by eMoney Advisor, and a key reason that Fidelity acquired the company in 2015), or at least are partnering with third-party PFM providers like Wealth Access who offer client-facing solutions hat capture the client's full financial planning picture.

Despite some progress in this area, though, the capabilities of financial planning software PFM tools for clients still vary greatly. Some are little more than a login portal for the client to view their current plan, while others give clients full access to the planning software itself. Many are still focused primarily on the retirement accumulation/decumulation projections and the household balance sheet, but are light on helping clients manage and monitor cash flow, while others are building out increasingly robust household-cash-flow tracking capabilities (so clients don’t have to track their own spending to understand their financial position).

Notably, for some planning software, the ability to offer a client portal also creates the opportunity for clients to do some of their own data input, either to update key numbers if the situation changes, or even to facilitate the entire data entry process when onboarding a new client (i.e., clients are able to key in all of their own data directly to the software!). For financial planning software that doesn’t have an online data input capability for clients, some at least partner with third-party solutions like PreciseFP that facilitate the process through available APIs.

In addition to the availability of a PFM portal for clients to access their plan, another related feature in financial planning software is whether it uses account aggregation to draw in the latest account balances, which obviates the need for at least some of the otherwise-manual data input to update the plan and even makes it possible for the plan to be “continuously” updated.

For planning software that has a PFM portal for clients, it’s typically a given that the software’s account aggregation tools will feed that data into the core financial planning software engine as well. However, for planning software that doesn’t have its own PFM solution, the question arises of whether it has any third-party integrations to maintain these planning data updates, either pulling the data from account aggregation tools like ByAllAccounts, Albridge, or CashEdge, or at least drawing in investment account balances directly from the advisor’s RIA custodian through platforms like TD Ameritrade’s Veo.

Notably, while advisors often ask for “all software to be integrated to other software”, in practice financial planning software often is not integrated to anything besides one of the aforementioned account aggregation tools to feed in account data, or perhaps a data input tool like PreciseFP. To the extent that financial planning software providers announce their “integration” to other types of software, it’s often nothing more than a Single-Sign-On solution that allows the advisor to click through from another piece of software (e.g., the CRM or portfolio accounting software dashboard) into the financial planning software, but doesn’t actually entail the integration and movement of relevant client data that would really drive advisor efficiencies.

Although usually more of an “add-on” than a deal-breaker, many financial planning software companies offer add-on tools beyond the core financial planning software, that may be relevant for the financial advisor. Some are arguably more “tangential” to the core financial planning software itself – such as the Advisor Briefcase content marketing solution from Advicent (makers of NaviPlan software), or the MyMoneyGuide marketing solution from MoneyGuidePro, or the RetireLogix mobile app prospecting tool from FinanceLogix. Others are more directly integral, such as the client portal from eMoney Advisor or Advicent’s soon-to-be-launched (at the time of this writing) Narrator Clients solution.

From the decision-making perspective, the reason that these add-ons become appealing is that, because they’re made by the financial planning software company, they tend to be more deeply integrated into the software. For instance, MyMoneyGuide’s marketing solution ends out getting the client to input all their own data into a self-guided module, which comes to the advisor as a pre-populated financial plan ready for client advice!

Still, for most advisors, the driving decision will be whether the core financial planning software itself is appealing, and only then will these other add-on services be considered, especially since many of the leading providers are all building their own end-to-end solutions (e.g., most but not all leading platforms now provide everything from financial planning software to a client PFM portal with account aggregation and also some form of advisor marketing tools and support).

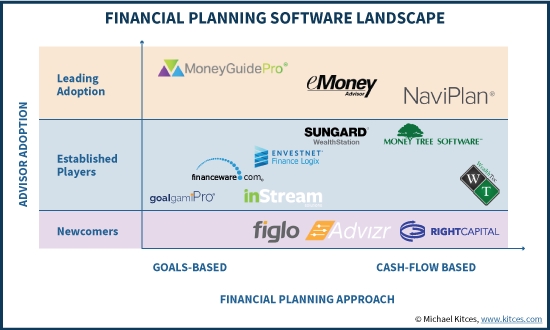

So given these dynamics, how do the various financial planning software solutions stack up? Because the overall direction of the industry is towards more comprehensive and engaging platforms, in general the solutions with the widest adoption already tend to have the widest feature set as well (due to the fact that their large paying user base gives them more resources to iterate and add the most features).

That being said, the overall focus of the software – goals-based versus cash-flow based – remains a meaningful way to distinguish the platform, and a number of newcomers are now trying to make their mark on the landscape as well. This chart provides an overall view of the financial planning software landscape, based on the software’s goals-based vs cash flow orientation, and the latest industry tech survey data on advisor adoption.

For a brief financial planning software review and details of financial planning software pricing for each of the companies, see below for further details! (We plan to follow up further in the coming year with more in-depth financial planning software reviews for each company's solutions.)

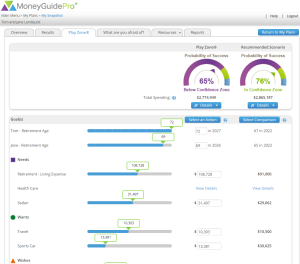

MoneyGuidePro (MGP) is the market leader in financial planning software adoption, as measured by reported usage from surveys of actual financial advisors. With robust usage amongst both large-firm enterprises, and independent advisors, MoneyGuidePro is recognized as the company that put “goals-based financial planning” on the map, when it emerged onto the scene in 2000. MGP was also one of the first financial planning software platforms to already be operating from the cloud in the early 2000s, giving it a breakout lead amongst its competitors (from which their competitors have never recovered!).

The MoneyGuidePro software has a long history of steady iteration and development, with an increasingly strong focus on client experience, and is generally viewed as software that is “easier to use” than many of its leading competitors, thanks in large part to its straightforward goals-focused orientation.

MoneyGuidePro is just coming out with its major version 4.0 release, dubbed G4. Notably, it is one of the few financial planning software platforms that does not have its own PFM portal for clients; as a result, advisors must generally purchase a separate solution to fill this gap (such as Yodlee PFM, Wealth Access, or even the recently unbundled eMx Select portal solution from "competitor" eMoneyAdvisor).

MoneyGuidePro Pricing: $1,295/year for a solo license (multi-advisor and enterprise discounts available, along with discounts through numerous membership associations).

eMoneyAdvisor is by most surveys the second-most-widely adopted financial planning software, and generally competes head-to-head with MoneyGuidePro. To the extent that MGP is recognized as “the” goals-based financial planning software, eMoney Advisor is known for being the financial planning software with “the” leading client PFM portal.

In fact, eMoney Advisor built its own client portal with account aggregation from scratch over the past 10 years, far in advance of any its competitors, and the strength of its portal allowed the company to vault into second place amongst planning software adoption.

The financial planning software itself has more of a cash-flow-based orientation than MoneyGuidePro, though not as “extreme” in its cash flow focus as some others, reducing the time for input and working with the software to analyze a client plan (though on the street, eMoney still has a reputation for being somewhat complex and time-consuming to use).

The software’s interactive capabilities for doing live collaborative financial planning have also improved greatly in recent years, with the rollout of its emX Decision Center, and the company continues to reinvest into what is already arguably an industry-leading client experience, and now has the full resources of Fidelity to leverage since it was acquired in 2015 (though eMoney remains independent and still available to all advisors, not just those on the Fidelity platform).

eMoney Advisor Pricing: While eMoney Advisor is certainly a highly capable financial planning platform, the company is well aware of its market position, and prices accordingly. The full emX Pro platform is more expensive than any other financial planning software around, starting at $3,888/year (priced at $324/month). A “light” version of the portal plus “basic” planning capabilities is available for $2,592/year ($216/month). Discounts are hard to come by, as eMoney Advisor has a notorious reputation for being difficult to negotiate with on pricing. For those who just want the eMoney client portal (and intend to pair the portal together with another financial planning software solution like MGP), the portal is available on a standalone basis for $1,944/year (paid as $162/month).

NaviPlan’s roots are serving as the quintessential cash-flow based financial planning software, the counterpart to MoneyGuidePro’s goals-based software. In fact, in the early years MoneyGuidePro differentiated itself by not being as tedious and detail-intensive to do data input as NaviPlan (though for those who preferred in-depth cash flow analysis, this is exactly what kept them with NaviPlan throughout).

Fortunately, NaviPlan’s transition to the cloud several years ago gave it the opportunity for at least a partial re-design, and the company made significant strides in improving the time to enter data and create a financial plan. Notably, though, in the transition to the cloud NaviPlan reduced some detailed cash flow features and alienated long-standing users, many of whom went to eMoney Advisor as the closest cash-flow based alternative. In addition, its slow transition to the cloud – NaviPlan only began developing a web-based version late last decade, and didn’t fully dial down its desktop version until 2014 – contributed to further losing market share. And three different company ownerships in the past 5 years haven’t helped, either.

Nonetheless, NaviPlan is still well recognized as the leading cash-flow based financial planning software. And its parent company, Advicent, appears to have newfound stability, aided by new leadership, which seems to be back on the development path again. The company also still has an incredibly robust base of advisors through their enterprise clients, including the majority of the top North American banks, broker-dealers, and insurance companies, giving it substantial resources to continue iterating future development.

Notably, Advicent also continues to support the Financial Profiles financial planning software (which has its roots in life insurance companies that did financial planning to show clients how underinsured they were), and recently acquired and rolled out Figlo financial planning software (reviewed separately below). (Advicent is also developing a full-fledged client PFM portal solution called Narrator Clients, but that is currently only available with Figlo.)

NaviPlan Pricing: Unfortunately, NaviPlan does not disclose its pricing on its website, and instead forces those interested to go through a demo process first. But the software is reportedly available for an individual license cost of $2,195/year - though in practice most advisors affiliated with a larger firm will have access to the software through their company’s enterprise pricing arrangement. Some discounts via advisor membership associations are also available, as well as discounts for buying a multi-year license.

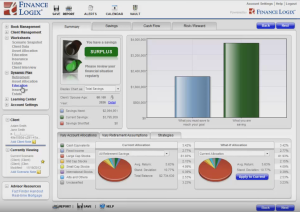

Because it is so often used as a private “white label” platform by large banks and other enterprise firms, many advisors who use FinanceLogix don’t even realize they’re using FinanceLogix.

Nonetheless, FinanceLogix has been around since the late 1990s, and founder Oleg Tishkevich has long pushed the envelope on financial planning software – FinanceLogix was the first to begin using interactive sliders to dynamically show alternative What-If scenarios for clients back in the early 2000s, and was early to adopt a client portal and offer a standalone mobile app for prospecting as well.

The FinanceLogix software itself is quite capable in tracking client cash flows as comprehensive planning software, but still manages to have a strong interactive and collaborative client interface, with a broad set of advisor and client tools and integrations (including its own PFM portal solution with account aggregation via Yodlee).

As with eMoney Advisor, FinanceLogix was also acquired in 2015 – by Envestnet – but remains available to non-Envestnet advisors as well.

FinanceLogix Pricing: Annoyingly, FinanceLogix does not disclose its advisor pricing on its website, and instead forces you to submit your contact information to their Sales team just to get a quote. But financial planning software and client portal capabilities are reportedly available for an individual license annual cost of $1,200, although notably getting the account aggregation data feed to actually power the software is an additional $1,500/year, bringing the total cost to $2,700. Notably, though, most FinanceLogix users do not buy independently, but instead have the software made available to them through their large-firm enterprise agreement. As with most platforms, multi-advisor discounts are available as well.

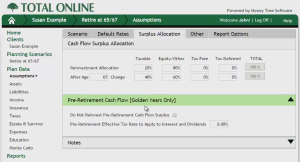

One of the longest-standing financial planning software platforms around, MoneyTree originated in 1981 and has a strong industry reputation for not only the accuracy of its calculation engine but the fact that the software output includes an audit trail to allow every number in the planning output to be reconstructed.

The core MoneyTree software is split into three tiers, which can be purchased separately or as a part of their “TOTAL” planning package: the Silver Financial Planner tool is meant for ‘basic’ planning with quick data input and simplified output; Easy Money covers everything that Silver does but provides a more comprehensive financial planning tool on top; and Golden Years allows for the most robust level of detailed cash flow projections (particularly around retirement liquidations and spend-down strategies).

Notably, MoneyTree was one of the longest-standing desktop platforms, and their TOTAL Online solution wasn’t even released until late 2013, which unfortunately has left the company playing “catch-up” on the web-based capabilities of some of its larger competitors; its financial planning capabilities are in line with its competition, but its client portal and account aggregation capabilities are just not as robust or flexible as solutions like eMoney Advisor, FinanceLogix, or Advicent’s Narrator Clients.

MoneyTree Pricing: The cost for MoneyTree software depends on which module(s) you purchase. Silver is $495 for the first year and $371/year thereafter, while Easy Money is $895/year and $649/year thereafter, and Golden Years is also $895/year and $649/year thereafter. Alternatively, advisors can buy Total ONLINE, which combines Easy Money and Golden Years (and thus effectively the entire MoneyTree suite) for $1,342/year. Desktop versions of the software are also still available, for the same upfront purchase but a lower cost for the subsequent renewals (since the advisor becomes responsible for hosting all client data).

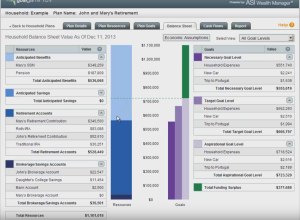

A common criticism of comprehensive financial planning software is that it’s too time-consuming to enter all the data and do the requisite analysis, so Advisor Software created GoalGami Pro to facilitate a “simpler” planning process with streamlined data entry to quickly reach some basic financial planning projections and results. The process can be further expedited by sending clients to the Collaboration Connect portal to enter their own data and plan details, so time with the advisor goes directly to the results and implementation stage.

GoalGami Pro is also somewhat unique in that it takes a strong focus on a “Household Balance Sheet” approach, pioneered by its founder (and former co-founder and chairman of Barra) Andrew Rudd. The Household Balance Sheet is a version of Liability-Driven Investing (LDI) applied in an individual context, where planned future spending is converted into a present value liability on the balance sheet to compare against current and future savings (and show clients a form of "funded ratio" for whether they're on track or not).

In practice, GoalGami Pro is most commonly known for its use in bank and large-firm channels with brokers who are primarily focused on product implementation, but want an expedited version of financial planning software to at least introduce and explore some financial planning concepts with clients. While the software is reasonable for this purpose, and some financial planners who don't want to go that in depth may find the software of interest for "smaller" clients, experienced advisors who like to go in-depth will likely prefer other solutions that can do expedited planning as necessary, but that also have the capabilities to go deeper if necessary for a particular client situation.

InStream Solutions is a financial planning software company founded by Alex Murguia, a principal in a wealth management firm of his own who set out to create better financial planning software that would be relevant for firms like his that do comprehensive financial planning and manage relationships on an ongoing basis.

A goals-based platform, InStream actually started out as a free financial planning software solution, with the vision of collecting enough advisors using the platform for free to surface big data insights that could then be sold back as recommendations for advisors (“other advisors with clients in a similar situation did this…”) or other interested parties. However, the company ultimately pivoted to a more “traditional” financial planning software company model of charging advisors for an annual licensing fee to use the platform.

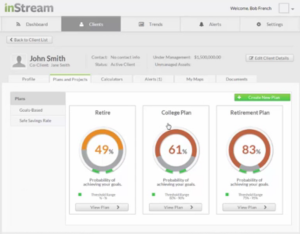

Nonetheless, InStream is somewhat unique in its focus on not just the upfront financial planning process, but tracking and monitoring client plans over time, allowing advisors to set alerts that inform the advisor when something notable has occurred – e.g., a critical wealth threshold has been reached – for a particular client plan. The software features a central Advisor Dashboard intended to be the central point for the comprehensive financial planner to manage and monitor all clients and their progress towards their goals.

InStream is also aiming to make its mark in the world of retirement planning by adding popular retirement researcher Wade Pfau as its Chief Financial Planning Scientist to help better incorporate the latest financial planning research into the software.

To date, though, InStream has still struggled to expand its market share in the highly competitive marketplace for financial planning software, although its users do include a deep relationship with mega-RIA Buckingham and BAM Alliance.

InStream Pricing: Instream Wealth is available for $115/month for independent advisors, or a slightly discounted $1,260/year for those paying the annual fee instead. Discounted rates apply for multi-advisor licenses.

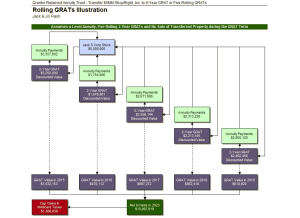

Amongst those who work with high net worth clients, who have complex needs ranging from exercising stock options and liquidating restricted stock, NUA distributions and complex Roth conversions, to evaluating the benefits of complex estate planning strategies from CRTs to rolling GRATs and more, WealthTec is arguably the go-to software.

WealthTec is not merely a cash-flow-based financial planning software solution, but a deeply analytical tool for financial planning, tax, and estate planning, for those serving ultra HNW clients – and accordingly, is used primarily by private banks and trust companies as their software of choice.

The big caveat, however, is that WealthTec has not been transitioned to the cloud – instead, it is the last holdout that still operates in a desktop environment, specifically as a series of Excel spreadsheet add-ons that do all the analytics and heavy lifting, and produce reports (which can then be outputted to .pdf format for a client’s written plan). As a result, the software cannot leverage most of the benefits of today’s online solutions, from client portals to account aggregation for data updates, and its interactive collaboration features are limited by the capabilities (or lack thereof) in Excel.

Nonetheless, for the complex needs of the ultra-high-net-worth client, WealthTec arguably has no competitors for its capabilities to illustrate the most complex financial, tax, and estate planning strategies. In fact, the company even offers a WealthTec PlanXPRT service (for a separate additional cost) for those who need additional support in fully utilizing the software’s capabilities to analyze client scenarios.

WealthTec Pricing: An annual license to WealthTec costs $1,495/year, with discounts available for multi-advisor licenses.

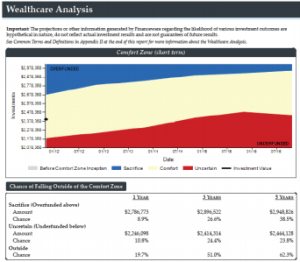

FinanceWare was the first financial planning software company to offer a web-based Monte Carlo analysis tool back in the late 1990s, and is still recognized for its capabilities to simulate potential wealth accumulation subsequent spenddown strategies modeled via both Monte Carlo and historical scenarios.

Notably, though, FinanceWare's WealthCare software is really focused primarily on “just” projecting the accumulation and decumulation of wealth. It is not built to model tax planning scenarios, estate planning, or other aspects of financial planning. In practice today, it is used most commonly in firms that are focused around assets under management and want to illustrate goals-based saving and retirement spending strategies in the context of how much portfolio risk to take in order to maximize the probability of achieving the client’s goals. The software is not widely used by independent advisors, but is still a pillar in some very large brokerage firms.

FinanceWare Pricing: Unlike most tools that simply charge advisors a flat annual license, FinanceWare actually prices based on the number of active clients in the system, with an “introductory” rate of $90/year per client. As a web-based tool, a white label co-branded client-friendly version of the platform is available for a one-time setup fee of $750.

WealthStation is part of the broader SunGard suite of technology tools designed to be a ‘one-stop shop’ for enterprises aiming to equip their advisors with the entire advisor technology stack. The platform includes both financial planning software, CRM, portfolio accounting and rebalancing tools, and a client portal. However, SunGard also offers WealthStation CompAct, a more simplified standalone goals-based version of the financial planning software.

As financial planning software, WealthStation is not quite as “in-depth” as tools like NaviPlan, but does offer the ‘usual’ suite of comprehensive financial planning tools, including both goals-based savings, retirement decumulation, college funds, and the impact of different investment portfolios on accomplishing those goals.

In practice, most SunGard users buy not just WealthStation CompAct or even just the full WealthStation financial planning software, but the entire WealthStation suite, so advisors tend to be “all in” or “all out” on the WealthStation suite. Given this dynamic, it is used most commonly by enterprises, particularly banks and broker-dealers, that wish to leverage the comprehensive WealthStation suite, rather than be responsible for managing all the individual components of the advisor technology stack.

WealthStation Pricing: The full Wealthstation suite costs $2,500/year, with “lighter” versions of the software available at lower price points, and a few specialized add-ons available as well (including SunGard’s popular AllocationMaster tool). Or advisors can purchase the simpler WealthStation CompAct on a standalone basis for $475/year.

Figlo is a financial planning software company based in the Netherlands, with a strong presence in the advisor marketplace throughout Europe. The company first made a push to bring their tools to the US nearly five years ago, but had very limited success in the hypercompetitive US environment, where most enterprises are already locked up into multi-year deals and gaining traction amongst independent financial advisors is slow.

In late 2014, however, Figlo was acquired by Advicent, the makers of NaviPlan, as Figlo had done extensive work developing a modern web-based financial planning software platform (with the flexibility to easily be adapted and deployed into various large-firm advisor enterprises) and Advicent was still trying to “catch up” after a slow cloud transition of NaviPlan and multiple ownership changes.

For much of 2015, Advicent worked to localize and adapt Figlo to the US marketplace, and started to deploy major releases of the software in the second half of last year.

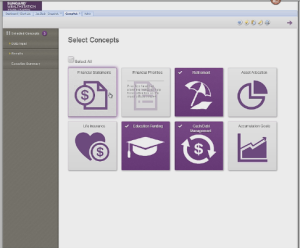

Advicent’s Figlo itself is a goals-based financial planning software platform, that is built around the concept of a client’s “financial lifeline” – a visual timeline of the client from now until the projected end of life, that variously turns red, yellow, or green based on the success or failure of the client’s plan. In this context, Figlo is very much built to be a collaborative and interactive financial planning experience.

Figlo also includes its own account aggregation and client PFM portal capabilities - called Narrator Clients - and increasingly appears to be the core platform that Advicent will build around, and into which it will likely eventually merge its legacy Financial Profiles clients (which in turns allows NaviPlan room to re-focus once again as a deep cash-flow-based financial planning software tool to compete with the likes of WealthTec).

Figlo Pricing: As with NaviPlan, unfortunately Advicent does not list pricing directly on its website, but Figlo is reportedly available for an annual cost of $1,495/year, which includes both the Figlo package, and Narrator Clients (and the underlying account aggregation, which is facilitated via Quovo).

Founded in 2013 by former financial planner Hussain Zaidi and his partners, Advizr is one of the newest financial planning software companies, trying to make its mark in a crowded marketplace.

The software includes in its core many features that have only been recent incremental add-ons to other tools, including a client portal with account aggregation to automate updates (and allow clients to enter their own data), an easy-to-navigate modern interface, and tools built to be used collaboratively with clients live in a meeting. More recently, the company also launched Advizr Express, a self-directed retirement planning tool that prospects can use via an advisor’s website as a “pre-engagement” tool to get them interested in a full financial planning engagement.

In terms of the core financial planning engine itself, Advizr takes a goals-based planning approach similar to tools like MoneyGuidePro and GoalGami Pro, allowing for retirement accumulation and decumulation projections (with some capability to go deeper on projecting cash flows), but is not built for doing detailed tax analyses.

More recently, Advizr announced a partnership with XY Planning Network to be offered as a core part of their platform, in combination with focusing the software more directly at the unique issues of working with “younger” Gen X and Gen Y clientele (where topics like Student Loan planning are critical, but poorly served by any other financial planning software), and is expected to expand further in the direction of being "financial planning software for younger clients" with relevant modules.

Advizr Pricing: The Advizr software is available for $75/month, which includes the full package of financial planning software tools and also client PFM portal and account aggregation benefits.

The newest financial planning software of all, RightCapital launched late in 2015 with a goal of delivering the

analytical depth of tax-sensitive tools like NaviPlan and MoneyTree, but built within a new and modern user interface.

So far, RightCapital still has a very limited user base as the “new kids” on the block, but has reportedly been building out in-depth tax planning tools to illustrate advice-based strategies like systematic partial Roth conversions and tax-sensitive retirement liquidations. From this perspective, RightCapital would be one of the most in-depth financial planning software tools for the tax-sensitive financial planner.

As with other “next generation” financial planning software tools, capabilities like a client portal with account aggregation (in the case of RightCapital, via Yodlee) are an “automatic” part of the platform, in addition to building out deeper financial planning capabilities using the latest of modern web design and UI.

RightCapital Pricing: $50/month for the financial planning software itself, or $75/month to include account aggregation capabilities.

In summary, the total annual cost for financial planning software varies significantly from one provider to the next, although most commonly the software falls in the range of about $900 - $1,500/year. In some cases, the differences in pricing are driving by differences in features, while in other scenarios companies may be "aggressively priced lower deliberately to gain market share as a newcomer.

Overall, the "center of gravity" for financial planning software is dictated by market leader MoneyGuidePro, which prices at $1,295/year, and most other financial planning software companies are priced in a manner to compete or contrast with MGP. The primary exceptions are NaviPlan, which prices at nearly $2,200/year on the basis of its in-depth cash-flow-based planning capabilities, and eMoney Advisor, which prices 'uniquely' based on its incomparable client PFM portal capabilities.

Notably, the total price of financial planning software will vary for multi-person firms, as some companies assign a price for a single advisor and allow the license to be shared, while others require each advisor to get their own license. Some companies even require associate financial planners or "assistants" to have their own license (sometimes at a reduced price), while eMoney Advisor is notorious for requiring every registered advisor in the firm (e.g., every registered person listed on an RIA's Form ADV) to pay for their own license, even if there wasn't any intention for every one of those advisors to use the software.

Ultimately, firms that are interested should obtain a quote directly from the software company pertaining to their specific situation. And as noted earlier, be certain to check if discounts may be available, either through your large-firm environment (if you're affiliated with a broker-dealer or RIA custodian), or through association groups that offer members affiliate discounts, like the Financial Planning Association's Member Advantage program.

So what do you think? What is your financial planning software of choice? Do you have a suggestion not listed here? Or some feedback about your own financial planning software experience that you'd like to add in? Please share your thoughts in the comments below!